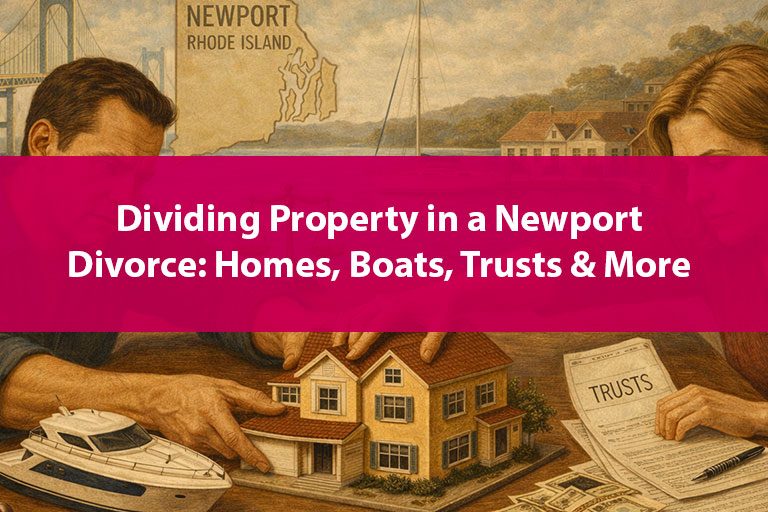

When you’re facing divorce in Newport RI, you’re likely dealing with more than just a house and a savings account. Waterfront properties, boats docked at the marina, family trusts, and complex investment portfolios all need to be addressed.

The stakes are high, and the questions are complicated: Who keeps the home where your children grew up? How do you value a yacht? Can your family trust protect certain assets?

Rhode Island’s equitable distribution laws apply to all divorces, but high-value assets add layers of complexity that demand experienced legal guidance.

If you’re concerned about protecting what you’ve built while working towards a fair outcome, understanding how these laws apply to your specific situation is the first step. Here’s what you need to know about dividing property in a Newport divorce.

Understanding Rhode Island’s Equitable Distribution Laws

Rhode Island is an equitable distribution state, which means property is divided fairly based on your circumstances, not automatically split 50/50, like in community property states.

“Equitable” means fair, and what’s fair depends on multiple factors specific to your marriage.

First, the court distinguishes between marital property and separate property. Marital property includes assets acquired during your marriage: your home, vehicles, bank accounts, retirement funds, and investments.

Separate property includes assets you owned before marriage, along with inheritances and gifts you received individually.

However, there are important exceptions. If you commingled separate property with marital funds, like depositing an inheritance into a joint account, that property may become marital.

When dividing marital property, Rhode Island judges consider several factors:

- Each spouse’s financial and non-financial contributions (including homemaking)

- Your respective earning capacities and future income potential

- Conduct during the marriage

- The length of your marriage

- Your health and age

Fault may also be a factor here. If one spouse committed adultery or engaged in economic misconduct like gambling away marital funds, that can influence how property gets divided.

In Newport, where estates often carry significant value, these factors carry even more weight.

A 20-year marriage involving a waterfront home, boats, and investment portfolios will be analyzed very differently than a shorter marriage with simpler finances. The court’s goal is fairness, not formula— and that’s why having an experienced Newport RI divorce attorney matters.

Real Estate and Your Newport Home

For most divorcing couples, the primary residence is both the most valuable marital asset and the most emotionally significant. In Newport, where waterfront properties and historic homes have appreciated considerably, real estate often represents the bulk of marital wealth.

Beyond market value, judges consider practical and emotional factors when determining what happens to the house. If you have children, the court may prioritize stability and allow the custodial parent to remain in the home, at least temporarily.

Courts can order a deferred sale to delay the property’s sale until children reach a certain age or graduate high school—but only if it’s economically feasible for the remaining spouse to cover the mortgage, taxes, insurance, and maintenance.

Second homes and vacation properties are also part of the equation.

If you own a cottage in Jamestown or a seasonal rental in Tiverton, these are typically treated as marital property subject to division. The same equitable distribution principles apply, though judges often view vacation homes as more easily divisible since they don’t involve the children’s primary residence.

Who Gets the House in a Newport Divorce?

There’s no automatic answer. The court considers which spouse has primary custody of your children, who can realistically afford the ongoing costs of homeownership, each spouse’s contributions to the purchase and maintenance of the property, and the practical versus sentimental value of staying in the home.

In many cases, one spouse buys out the other’s equity interest and refinances the mortgage to remove the departing spouse from liability.

This allows one person to keep the home while the other receives their share of the equity. The court’s ultimate goal is to reach a decision that balances both spouses’ needs with the children’s best interests.

Boats, Yachts, and Waterfront Property

Newport’s maritime culture means boats are often significant assets. Whether you own a sailboat, powerboat, or yacht, these vessels are typically treated as marital property if they were acquired during your marriage, regardless of whose name appears on the title or registration.

If marital funds were used to purchase or maintain the boat, it’s marital property even if it’s titled solely in your name or your spouse’s. This extends to yacht club memberships, boat slips, and associated equipment.

The court will also consider ongoing costs like storage, insurance, and maintenance when determining which spouse should keep the vessel— or whether it should be sold and the proceeds divided.

How Do You Determine the Value of a Boat in Divorce?

Accurately valuing a boat typically requires hiring a professional marine surveyor or appraiser. These experts assess the vessel’s age, make, and model, along with its current condition and maintenance history. They’ll evaluate any upgrades or customizations you’ve made and compare your boat to similar vessels recently sold in the market.

Documentation is crucial here. Gather purchase records, maintenance logs, and any insurance appraisals you’ve had done.

If there’s outstanding financing or liens against the boat, those reduce its net value. Timing matters too— the marine market has seasonal fluctuations, which can affect both valuation and the practical timing of a potential sale.

Trusts and Investment Portfolios

Many Newport families have established trusts for estate planning or wealth preservation, and these structures add complexity to property division. Unlike simple bank accounts, trusts involve legal frameworks designed to protect assets— but that protection isn’t absolute during divorce.

The type of trust, when it was created, and how it’s been managed all influence whether it remains separate property or becomes subject to division.

Investment portfolios present similar challenges but with different mechanics. The portion of 401(k)s, IRAs, and pensions accrued during your marriage is marital property, even if the account is in one spouse’s name.

Complex portfolios may even require expert financial testimony to establish accurate values. If you’re concerned about hidden assets or suspect your spouse hasn’t fully disclosed their holdings, a forensic accountant can trace transactions and uncover what’s not being reported.

Can a Trust Protect Assets From Divorce in Rhode Island?

It depends on the type of trust and when it was created. Trusts established before your marriage and funded with premarital assets are generally protected as separate property. However, trusts created during the marriage using marital funds may be subject to division.

The distinction between revocable and irrevocable trusts matters significantly.

Even when the trust principal is protected, income generated from that trust during your marriage is often considered marital property. There’s also the risk of transmutation— if trust assets were commingled with marital accounts or used for marital expenses, they may lose their separate property status.

Courts will carefully examine the trust’s structure, its funding source, and beneficiary designations when making these determinations.

Protecting What You’ve Built While Moving Forward

Newport divorces involving substantial assets aren’t straightforward. You need an attorney who has specific experience with high-value property division and understands how to protect your interests when the stakes are this high.

With over 25 years of experience handling complex divorces throughout Rhode Island, Massachusetts, and Connecticut, attorney Susan T. Perkins has guided countless clients through the challenges of dividing waterfront estates, maritime assets, trusts, and sophisticated investment portfolios.

Whether you’re concerned about keeping your family home, fairly valuing a yacht, protecting trust assets, or ensuring your retirement accounts are handled correctly, you don’t have to navigate the divorce process in Newport, RI, alone.

The Law Office of Susan T. Perkins offers a free 60-minute consultation to discuss your specific situation and explain your options. Call 401-PERKINS (401-324-2990) today to schedule your consultation and take the first step toward protecting what you’ve worked so hard to build.

CALL US NOW

CALL US NOW